Contents:

It is one of the most approachable and dependable methods in existence. Trend lines are the identifiers and connectors of resistance and support in chart patterns. Top 10 Price Action Trading Books – Books that offer excellent price action trading insights. How To Trade With Price Action – Dozens of price action trading resources. The first is to hone your price action trading skills. The second goal is to practice control over your emotions and cognitive biases.

Either way, long wick candles are a must-watch for price action traders. Traders monitor “swing highs” and “swing lows”, or the length of the trending and pullback waves, to identify the direction of the trend. During an uptrend, the rules are that the price makes higher swing highs in price, and higher swing lows. The troughs and peaks of trendlines float between lines of support and resistance on a price chart. All economic variables create price movement which can be easily seen on a market’s price chart.

In the screenshot below we see a downtrend in which the price traded sideways for an extended period of time. We can also see the buildup component as the price keeps returning to the resistance level sooner and sooner. Price is king but what does it take to trade price action successfully and why do so many traders struggle with it? The answer is often surprisingly simple and you can often improve your price action trading with just a few tweaks. An example of such a pattern is a trendwhere higher highs and higher lows alternate regularly in the case of an uptrend or lower high and lower lows in the case of a downtrend. The price action traders use the principle that is based on the second test of the level at which the price turned in the past.

In an upward trend, your strategy is to buy low and exit the trade when the price rises. In a downward trend, the strategy is to sell when the security’s price is high and exit when it is low. Why you did not mention anything about the volume of trades, and the impact on the trade. I have no doubt there is cue of traders waiting to buy and sell, they are the ones the move the market up or down.

How to Draw Trend Lines Perfectly Every Time

As long as the how to trade price action is making higher highs and higher lows, it’s in an uptrend. Using the daily time frame, identify the swing highs and swing lows. However, if you’re serious about trading with Forex price action, using New York close charts is a must. The advantage of trading this way is that it gives you insight into where buy and sell orders are located. We use the upper and lower wicks of candlesticks to view these buyers and sellers.

VGX Price Prediction: What is Next for Voyager Token after Binance … – Blockchain Reporter

VGX Price Prediction: What is Next for Voyager Token after Binance ….

Posted: Sun, 02 Apr 2023 11:37:59 GMT [source]

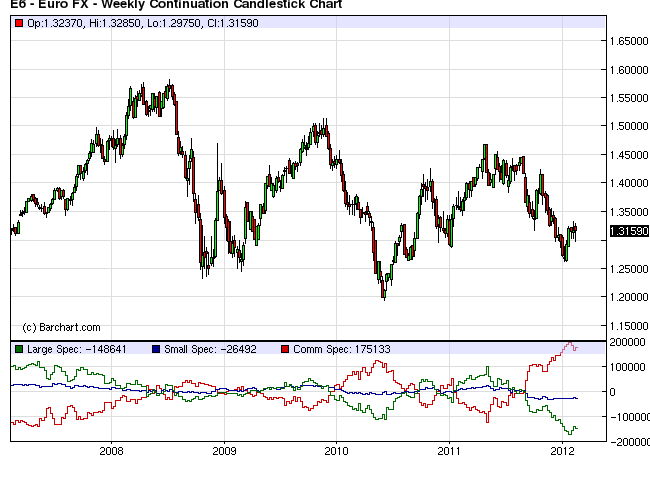

It’s worth pointing out how in the indicator-laden chart you actually have to give up some room on the chart to have the indicators at the bottom, this forces you to make the P.A. Part of the chart smaller, and it also draws your attention away from the natural P.A. So, not only do you have less screen area to view the P.A., but your focus is not totally on the price action of the market like it should be. Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

Let’s consider another way to apply the Price Action and VSA strategy. This strategy enables one to analyze the trend state, its direction, speed and strength. The candlestick range is considered, as well as their patterns and traded volume. Of course, one should learn scalping basics to trade with this strategy successfully. Scalping suggests trading in short timeframes, from five minutes to one minute, holding trades for a short time and closing with a small profit. That is why a scalper should be flexible and easily adjust to the changing market conditions and shift from buying to selling quickly.

Safety on Forex & Forex Trading Scams: How to protect your trading account?

Imagine making trading decisions based on the actual movement of price itself. In general, an uptrend is defined by higher highs and higher lows , while a downtrend consists of lower lows and lower highs. Some traders draw simple trendlines to identify these movements. Candlesticks are graphical representations on a chart that show the trend, open, close, high, and low price of an asset. For example, when usingcandlestick charts, some traders use theengulfing candle trend strategy. A trader should confirm indicator signals with candlestick patterns and strong levels.

This strategy works when there is an existing pattern or consolidation. First, we recommend that you do a multi-timeframe analysis. This is where you start your analysis by looking at a longer duration chart and then narrow it to a smaller one. Very2….helpfull to me as newbie in forex,i like trading no indicator just look at price moving…trend..pinbar…inside and others…thanks master ray…i always read your web.

The only relevant trade elements for a price action trader are price and time. This makes a price chart the most important trading tool for a price action trader. On almost every platform, candlestick charts are the most popular due to the detailed information they give traders on asset prices as well as their graphical appeal. A typical candlestick will display the high, low, opening and closing prices of an asset over a specified period. On most platforms, a candle with a higher closing price than an opening price is green in colour , whereas a candle with a lower closing price than its opening price is red . The price of a financial asset, such as a share, currency pair or commodity, is essential to trading, as ultimately, it is the shift in price that produces profit or loss.

Price Action

If you look from left to right, the first of them was the border of a short-term uptrend, and the second – the border of a short-term downtrend. In the first case, there was a test of the support level on small volumes. Despite the fact that the level was held and the price increased further, it is not recommended to trade such a pattern. The first Pin-bar for a rebound from the level was formed on falling volumes.

Thank you very much for sharing your knowledge, skills and talent in trading.. I am just in about a year in trading forex and still learning new strategies and techniques to say that i am progressing. I don’t have any countermeasures as the stop loss is in place. So it’s either I get stopped out, or price moves really in my favor.

In this article, we explore the techniques and indicators that will help in building this strategy. Technical analysis uses a range of different calculations to predict future price movements. By contrast, price action relies only on the price movements of an asset within your trading timeframe. Price action is among the simplest and most effective trading methods.

Robust price action trading should work on all timeframes, not just the higher timeframes in my opinion. Taking your signal bars on a 5 minute chart would cause many many stop outs before one would work out, simply because of the noise. Unless you have other signals bars to enter on smaller timeframes of course.

It is up to the individual trader to clearly understand, test, select, decide and act on what meets the requirements for the best possible profit opportunities. The tools and patterns observed by the trader can be simple price bars, price bands, break-outs, trend-lines, or complex combinations involving candlesticks, volatility, channels, etc. Sometimes called the candlestick strategy because of its distinctive shape, the pin bar pattern looks like a candle with a long wick on it.

Head and shoulders reversal trade

Keep it up Rayner, really appreciating the free nuggets you been giving. My losses were well, little compared to all the account I blowed up before. This is probably the longest time my real account have ever withstand!

Whether an economic variable is filtered down through a human trader or a computer trader, the movement that it creates in the market will be easily visible on a price chart. Examples of these are buying dips in uptrends or rallies in downtrends. Entering a failed breakout of a range that fades back inside the previous resistance or support. Extreme oversold or overbought levels that move to extremes in deviations from the mean of the 20-day moving average.

Most importantly, the traders feel in charge, as the strategy allows them to decide on their actions, instead of blindly following a set of rules. For example, if a price is trading at higher highs and higher lows, this indicates that it’s on an upward trend. If it’s trading at lower highs and lows, it’s trending downwards.

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

It is based on the pivot levels or strong support/resistance levels. The application of the second method to put a stop loss depends on the trader’s skill to correctly interpret and discover strong support/resistance levels. If you are a newbie in trading, I recommend you use the first method. A stop loss is at a long distance; however, it is safer.

This https://g-markets.net/ has covered the fundamental principles of the Price Action trading strategy. It should be noted that the technique is simple and universal. With Price Action, you can trade in any market and any timeframe. A Take Profit is set beyond the local high or low, where the correction started. A part of the profits could be taken at the intermediary support/resistance levels. The second test of the level ended with a doji candlestick with a long lower shadow, which means that sellers can’t break out the level downside.